Financial institutions have complex portfolios of products presented to customers in a siloed, product-centric fashion, which makes shopping for financial products inefficient and reduces the overall customer experience. However, digital delivery promises to improve customers' shopping experience, CX, and CSAT.

Some firms in other industries have been doing this successfully, such as Disney for its theme parks. Each theme park has a complex set of offerings to choose from, and Disney uses its MagicBand to connect consumers to all their choices within the park and deliver the final experience. However, developing a customer-centric, unified shopping experience for financial services remains an industry challenge. In the early 2000s, Citibank tried to address these issues with its “Financial Supermarket” concept, But by 2008, the Citibank experiment famously failed.

Capgemini’s client-centricity framework

Capgemini and Salesforce are working together to enable enterprises to deliver customer-centric, unified, and optimized consumer experiences for financial services, similar to the Disney MagicBand concept. Capgemini has built a client-centricity framework to identify customer drivers and enterprise enablers that will support reengineered customer engagement, and in turn, drive revenue growth and improve customer satisfaction. Critical components of Capgemini’s client-centricity framework include:

- Customer drivers:

- Personalization: tailoring the customer’s experience

- Availability: ubiquitous, 24/7 access and responsiveness to customer inquiries/demands

- Trust: built via reputation, ethics, and actions

- Diverse offerings: providing a wide range of financial offerings

- Autonomy: empowering customers to make informed decisions

- Enterprise enablers:

- Strategy Alignment: ensuring corporate strategy aligns with customer needs

- Data capabilities: employing data to customize offerings to individual customers

- AI/technology upgrade: re-engineering the technology platform to a customer-centric approach

- Operating model automation: digitalizing and automating all operations delivery to customers

- Culture: attracting, training, and retaining employees with high domain knowledge and customer interaction skills.

Effective organizations can analyze customer drivers in real-time and prioritize offerings and fulfillment to meet a customer’s needs.

Salesforce technology

Salesforce provides the solutions and platforms to integrate and deliver enablement for clients. Key Salesforce offerings used in the partnership include:

- Data Cloud: the platform integrates sales, service, and marketing data from multiple silos to create a single experience across customer-facing functions

- Sales Cloud: a sales management solution providing lead and pipeline management, forecasting, and AI insights

- Service Cloud: a customer services platform that helps businesses manage and resolve customer inquiries and issues

- Marketing Cloud: the platform integrates data, teams, technology, and AI to enable real-time personalization

- Experience Cloud: enables a business to create branded digital experiences to share information and collaborate

- Financial Services Cloud: a platform built on the SF Sales and Service Cloud platforms but customized for the financial services industry, including industry compliance requirements and data compliance. Initially designed for the wealth management industry, it supports relationship managers managing customer relationships

- Einstein 1 and Co-pilot Studio: AI assistants that respond to natural language inquiries

- Next Gen Tableau: automates data analysis, predicts user requirements, and generates actionable insights.

These solutions provide functionality to enhance data quality and integrity, provide contextual suggestions, and customize AI actions to specific customers.

By combining these two offerings, Capgemini’s client-centricity offer and Salesforce’s Sales and Experience Cloud offerings, financial institutions can deliver hyper-personalized customer experiences based on their individual preferences. The AI embedded in these platforms enables advisors and customers to find available financial products that are relevant. Current engagements are delivering these capabilities to banks. Here is a recent example:

Client example: large U.S. bank

Challenge

A leading retail bank could not deliver the seamless customer experience it wanted. Specific challenges included:

- Fragmented customer experience due to the lack of a unified digital solution. Lack of a 360° customer overview resulting in a poor time-to-market for new product launches

- Fragmented operational silos, which created a disjointed customer journey, the slow release of solution enhancements, and reconfiguration challenges

- Manual interventions to communicate data across silos reduced visibility and increased error rates in market and transaction data.

Scope of Services

- Integrated and deployed an integrated solution of Salesforce, Mulesoft, and Marketing Cloud across all systems

- Solution was delivered across experience strategy, roadmap development, design, implementation, and standup

- Phased deployment strategy to minimize risk

- New activation channels were opened based on predefined segmentation to enhance customer engagement.

Benefits

- Customers experienced an omnichannel experience with priorities based on customer goals, regardless of initial channel entrance

- Improved lead management, resulting in increased conversion ratios

- Minimal impact on legacy systems

- Elimination of manual processes leading to lower error rates, faster throughput, and enhanced CSAT

- Integration benefits included real-time reporting to speed up troubleshooting, provide insights into customer behavior, and assess system performance.

As this case demonstrates, customers no longer have to “stumble upon” products that meet their needs by accessing multiple product silos; the platform can sift through an ocean of data to narrow down offerings and present a few highly relevant suggestions for final consideration. This should make dealing with a bank less stressful and more satisfying.

]]>

NelsonHall recently attended the Infosys U.S. Analyst Day in Dallas, the theme of which was “Being AI First”. It demonstrated clear progress since last year’s conference in Infosys’ thinking and approach to the critical steps for effective implementation and operational deployment of AI.

Key components of AI-led operational transformation

Infosys and its clients attending the conference identified three essential components to enabling an effective AI-led operations transformation:

- Stakeholder interaction and co-development of problem definition, goals identification, roadmap development, and operations transformation

- Data hygiene, including sourcing, scrubbing, QA, and distribution

- Segmentation, identifying which data, processes, and projects will remain managed internally and which are moved externally.

To drive the first component of stakeholder interaction, Infosys pursues a hub-first strategy for innovation. Hubs are operational centers of expertise where Infosys and its clients work on client projects to develop novel POCs and operational deployments. Clients prefer to be involved in innovating their operations and have relevant input to shape and drive the innovation process. This enables a co-creation process that allows enterprises to focus on innovation at a higher success rate. Infosys values the feedback, domain expertise, and deep knowledge of an institution’s differentiating factors that clients provide in a hub environment.

To drive innovation in a tightly coupled co-creation environment, Infosys has built tech and innovation hubs worldwide. In the U.S., it had committed to building four hubs in 2018, but it has set up six because of client demand. The six hubs are based in Providence, RI; Richardson, TX; Hartford, CT; Raliegh, NC; Indianapolis, IN; and Phoenix, AZ.

The ideation from hubs needs to be realized with AI functionality and delivered with operational flexibility. To enable that synthesis, Infosys has coupled two of its platforms, Topaz (an AI-first offering that helps enterprises create value from generative AI technologies) and Cobalt (a set of services, solutions and platforms for enterprises to accelerate their cloud journey), to speed up ideation and the operationalization of successful POCs. This enables innovation at both speed and scale.

To continue growing its capabilities, Infosys is investing in AI to support operational transformation. Infosys’ significant investments in AI-led transformation are:

- Infrastructure-led transformation to the cloud

- Data and AI transformation leveraging the cloud

- Business transformation led by enterprise apps and SaaS

- Platform engineering

- Non-IT workloads to the cloud.

Infosys’ AI-first strategy for financial services

Infosys has built its most comprehensive domain-specific AI capabilities for the financial services industry. Financial services is the largest industry segment for Infosys (~30% of revenues), and North America is the largest single market (~60% of total revenues).

Infosys’ AI-first strategy for financial services focuses on nine areas it uses to help banks improve their business performance. The focus areas are:

- Personalization at scale for sales and marketing

- Deepening relationships by helping advisors work with customers

- Portfolio management and product design and testing

- Risk scoring for credit, AML, KYC, and onboarding

- Operations improving CX and employee experience

- Modernizing tech and infrastructure with AI

- Talent and change management

- Making the enterprise data ready.

Client use case

Infosys provided a use case of a credit union. The credit union has been committed to giving back to its employees and members, and had to identify how changing technology and member preferences could be fulfilled and achieved with new delivery techniques and offers. Data is the core of the financial services industry, And the credit union segmented its data into three areas:

- Foundational data: this is unchangeable data that should remain on-premises. Examples include identifier data and legally private data

- Core data: this data includes transaction data and transient entity data. Examples include KYC, AML, fraud, and transaction data. This data can be moved to the cloud

- Sales and marketing data: this data changes rapidly in response to changing market conditions and various product campaigns. This data should be kept in the cloud from the start because it has a very short lifespan. However, the research data supporting the campaigns comes from internal and external data and, therefore, should not be kept in the cloud.

Infosys identified 200 use cases to manage the data and drive better customer value. Cases were ideated, POCed, and operationalized in a disciplined waterfall where unpromising use cases were dropped. The primary driver of use cases that make it to full operational deployment is customer data rather than product data. The client started the initiative with employees and leveraged Infosys’ tools and support to enable it to develop offerings and delivery methodologies that appeal to a younger generation with differing priorities and needs than the older generation.

Summary

Intelligent automation and data transformation POCs and projects have gained traction over the past year, propelled by the GenAI opportunity and hype. Only some of the many POCs and MVPs have translated into operational transformation at scale. Infosys’ approach to using AI to drive operational change uses client co-creation to build differentiating operational change, data hygiene techniques to enable effective analysis, and rigorous segmentation of data, projects, and processes to set role-based responsibilities. This approach allows for change to happen quickly and at scale.

Infosys provided examples of how it delivers these services in the financial sector, including regional and local banks. These banks represent a larger addressable market for IT services vendors than tier-one banks because they have older legacy systems and will be less likely to retain as high a level of internal operations as the tier-one banks in the long run.

The challenge for vendors is to identify compelling value propositions for clients. Infosys has addressed this challenge with its localization initiatives that drive the co-creation of differentiated operational offerings at scale. Data drives the financial services industry, and Infosys’ activities with a credit union, described above, outline how a data transformation program can be handled.

]]>

Financial institutions are rapidly starting or growing existing wealth and asset management businesses. In the U.S., wealth assets under third-party management have grown over the last five years by 16.8% CAGR to 2023 (Source: Statista). Wealth advisors are looking to continue to invest in and grow their wealth management businesses because they see continued growth coming from:

- Generational transfer of wealth from baby boomers to younger generations. The estimated transfer of wealth is $84 trillion over the next 20 years (per Cerulli Associates)

- Perceived risk of an economic downturn by the management of financial institutions. This would lead to significant losses in risk portfolios for the banks. However, wealth management is a fee-based business and not subject to capital losses.

NelsonHall’s operations research finds new customer demographics can be profitably served with digitalized service delivery. These customer demographics are the mass affluent and the unbanked. Government initiatives such as India’s program to issue Aadhaar numbers to all citizens enable previously unbanked citizens to access financial services. Governments are moving towards individual retirement funding, necessitating individuals to start saving. Digitalization of service delivery allows profitable service delivery to a much larger mass affluent customer base.

Changing customer base

The growth in the wealth advisory industry is driven by a changing customer base, which has very different priorities and expectations from the traditional wealth client base. Key new customer priorities are:

- Investments that reflect the client’s values. Examples include investments that score well on ESG and transparency. Weaknesses in effective scoring and benchmarking these attributes remain a challenge

- Digital engagement with advisors. Today’s customers are familiar with digital engagement and expect to have it across their entire environment. Currently, most younger wealth management customers are unhappy with the quality and functionality of their wealth managers’ digital interaction offerings

- Digital tools to educate themselves and provide portfolio and return attribution analyses. The quality of these tools varies widely across wealth managers. Current tools are perceived as inflexible and lacking functionality

- Support for multiple family members. Wealth managers no longer interact with one founder as wealth is transferred to the next generation. As multiple family members are active in decision-making and often pursue different goals from each other, the wealth managers need to support cooperation between family members and customize services for individual needs

- Easy to understand investment strategies. Many investment advisors previously advised on complex investment strategies and structured instruments. Today, investors are looking for simpler investment strategies, such as indexing, to deliver investment performance for them.

These customer priorities and the operational challenges that inhibit them from achieving their goals are driving new initiatives in the industry to enable wealth managers to change their business models and deliver new services.

New wealth & asset management initiatives

New industry initiatives include:

- Cloud delivery for processes that execute outside the firm. Examples include shifting processes to the cloud, which supports external users, especially:

- Third parties such as independent wealth advisors (in the U.S., they are known as Registered Independent Advisors or RIAs) who sell services directly to the financial institution's customers. Cloud-delivered services are efficiently delivered anywhere and offer multiple solutions using APIs to accommodate the legacy solutions of the independent advisor

- Social sentiment collection, analysis, and reporting. Increasingly, investments are being evaluated using social sentiment as part of the analysis. Hyperscalers are delivering AI tools to support the analysis of social sentiment as part of their overall service offerings

- Direct-to-customer data access. As clients increasingly demand more self-service, they need access to both data and AI tools to perform their custom analysis. Hyperscalers have developed ecosystems with both data vendors and AI solution vendors that customers can access to create their custom analysis

- Compliance services that are perceived as a non-differentiating cost. That cost can be minimized by sharing best practices and utilizing a shared environment. In the past, the industry shared best practices in industry forums. Cloud delivery enables industry participants to share infrastructure and best practices continually. Cloud also enables real-time response to threats and deadlines to be shared faster and more effectively

- AI is being deployed to bring highly personalized offers to customers. Examples are the use of AI to:

- Support advisors in developing investment plans for customers

- Enable customers to shop investment offerings using self-service

- Enable customers to do independent investment analysis

- Data management is changing from a siloed approach by investment product type to data collection, analysis, and reporting organized by customer.

These operational transformation initiatives make wealth and asset managers directly accessible to third parties, including customers and business partners. The changes will bring many startup service providers to the wealth management industry. Ultimately, IT services vendors supporting the industry will need to be able to support the IT needs of tiny enterprises to continue effectively servicing the industry. That, in turn, will drive significant change in the IT services industry.

]]>

In 2024, the financial services industry will face strong economic headwinds. Usually, this is a formula for downsizing and consolidation. However, today’s headwinds are so strong that the industry will need to:

- Assess and restructure its supply chains to address new priorities such as ESG reporting

- Accelerate customer experience transformation to increase personalization and deliver many new, relevant product offerings

- Sell many more of its operations captives to accelerate digitalization and improve the brand experience across markets and business lines.

Prediction 1: ESG reporting

ESG activities will increase in North America, Europe, and India. There will be an increasing focus on auditability to mitigate “greenwashing” criticisms and make it more difficult for unscrupulous actors to engage in greenwashing initiatives.

Regulations will drive ESG adoption in 2024. The most advanced and demanding regulations are coming from thought-leading regulators in Europe, the U.S., and India:

Europe (Germany)

- January 2024: the EU’s Corporate Sustainability Reporting Directive (CSRD) requires companies to disclose their risks from environmental and social factors

- December 2023: the European Banking Authority disclosure of assets and activities and their exposure to climate change, customers’ and suppliers’ carbon exposure, Green Asset Ratio (GAR)

- June 2024: the European Banking Authority Banking Book Taxonomy Alignment Ratio (BTAR).

United States (California)

- April 2024: SEC-regulated companies must report their GHG emissions

- December 2024: Companies in California must establish processes for auditing their emissions data in anticipation of the 2026 reporting requirement.

India

- April 1, 2024: India’s 250 largest listed entities need to provide value chain ESG disclosures (the largest 150 entities were required to do so in 2023).

These regulations all target supply chain emissions and improve the auditability of enterprise ESG reporting. Many regulations target large corporations but, over time, anticipate lowering the size requirement for reporting ESG activities.

Prediction 2: accelerating digitalization of customer experience

In 2023, banks continued closing branches. 2023 was the fourteenth year of declining branches for U.S. banks, With PNC Bank and U.S. Bank each closing 10% of their branches. The decline of in-person banking options will continue to drive the digitalization of the customer experience. AI, including Generative AI, will drive the increasing adoption of digital customer contact services. The focus in 2024 will be on:

- Hyper-personalization of service offerings in response to a customer’s stated and implied preferences. These AI offerings will deliver less clutter to the customer and drill down to offer a few relevant offerings. Retaining these preferences will enable the customer to maintain an ongoing virtual conversation with the bank, rather than the current state of retelling the bank one’s preferences and goals each time the customer engages with the bank

- Accelerated adoption of open banking partnerships focused on providing specialized lending offerings to customers. Open banking has been slowly developing in response to regulatory requirements. Today’s economy has left banks facing capital and cost challenges, causing them to restrict their lending services. Meanwhile, customers seek customized lending services that meet their need for rapid approval and specialized financing for certain products or services. Open banking will enable banks to offload risk asset creation while enabling FinTechs to provide customers with specialized financing, including green loans. Many FinTech loan offerings delivered by open banking will be embedded finance offerings, becoming the future lending model.

Prediction 3: selling off captive operations

Financial institutions will sell many of their captive operations to improve cost efficiency. The emphasis will be on realigning costs to transform the bank’s business model. This will drive improved customer experience and greater operational agility across multiple businesses and markets.

The financial services industry is facing revenue declines and is looking to cut costs. The Financial Times estimates that the 20 largest global financial institutions have cut over 60k jobs in 2023 as of mid-December. This is the largest single-year decline in financial jobs since the Great Financial Crisis in 2008-09. Other industries are doing worse. Bloomberg estimates that 250k tech workers have already lost their jobs in 2023. The final numbers for the global economy will be larger, making cost control an even higher priority for businesses.

Captives are sold to third parties for three reasons:

- Operations and business model transformation: today’s banking economy necessitates banks transform their operations to service high-volume delivery at lower cost (e.g., premium wealth management services for mass-affluent clients and banking services for previously unbanked populations). Enabling this business shift requires pervasive digitalization of delivery, customer self-service where possible, and AI support for any remaining humans in the loop

- M&A enablement: banks are exiting non-core business lines and scaling core businesses. Most of the cost benefits of mergers are realized by rapidly integrating the two businesses. Third-party support for integrating the acquired entity into a single shared service center requires a technology operations provider focused on this transformation, after which it will scale down the integration force. Only third parties can provide the necessary skills at scale and still downsize upon completion

- Cost savings from reducing inputs (primarily labor) and sharing overhead across a larger operational volume (transforming a single tenant operation to a shared services environment).

Examples of these types of captive acquisitions include:

- Infosys-Stater: Stater is a large mortgage services provider in the Benelux countries. Infosys acquired 75% of Stater from ABN AMRO and is automating and managing its service delivery

- Infosys-Vanguard: Vanguard’s defined contribution business has partnered with Infosys to manage its service delivery, improve customer experience, and move its recordkeeping to the cloud

- TCS-Standard Bank (the largest African custodian): TCS will centralize and standardize the bank’s custody and securities settlement operations across 15 markets in Africa using TCS’ proprietary securities platform.

These activities will accelerate the digitalization of banking processes and the extent of open banking where institutions partner to deliver offerings to banking customers on shared platforms.

To keep up to date with NelsonHall's Banking research and thought leadership in 2024, subscribe to our Banking Insights newsletter on LinkedIn.

]]>

ESG services are an emerging set of tracking and reporting capabilities for enterprises. Emerging technologies do not mature in a straight line but cycle through peaks and valleys of development and adoption as they mature. In the past year, ESG services have passed from the euphoria stage of market adoption to the valley stage as the hype has been confronted by the real-world challenges of failure to meet expectations and outright fraud in some cases.

I am currently conducting a market assessment of how ESG services are transforming the banking sector, and here are some early findings.

ESG in Banking: early findings

The financial services industry is an early adopter of ESG reporting due to regulations that set implementation deadlines, and because of the data-heavy nature of the business.

Adoption is currently immature but is growing rapidly. Financial institutions are applying 60% of their efforts to environmental services, 30% to social services, and 10% to governance services. Social and governance initiatives are growing faster than environmental initiatives.

Currently, 70% of banks’ ESG initiatives are internal business activities, 20% investing and lending, and 10% supply chain activities (banks have small supply chains relative to manufacturing, wholesale, and retail).

Also, 80% of ESG activities have been focused on reporting, primarily for regulatory purposes. The remaining 20% of activities have focused on mitigating adverse ESG outcomes. As financial institutions are enabling better reporting, they are now accelerating their mitigation efforts.

Adoption is highest in Europe because its regulations are stricter than in other geographies, with earlier implementation deadlines. North America has the second highest level of ESG adoption. Regulations for ESG adoption in North America and Europe generally follow the same principles, with Europe implementing its regulatory deadlines earlier and with higher remediation hurdles. The rest of the world lags behind these two markets in adoption and has far less consistency in applying principles.

The adoption of ESG services in banking is concentrated in the following processes:

- Green IT: banks do not engage in manufacturing but manage large amounts of data. As such, their primary activities are delivered by IT systems. Reducing a bank’s carbon footprint in IT services is the primary path to increasing sustainability in bank operations

- Inclusion in lending/saving: a large percentage of all populations do not have formal banking relationships. Banks are reaching out to underbanked people as part of their social initiatives to provide banking services to unbanked consumers. The country with the highest level of activity in this area in India

- Rating investments based on ESG criteria for wealth and asset managers. This has been driven by regulation and customer preference. Sourcing, managing, and reporting the data is a massive undertaking, the buildout of which remains ongoing

- Rating carbon emissions data for real estate (buildings). Banks own, invest in, and finance real estate. Sourcing, managing, and reporting this data is more mature than for investments, but it is still an area that is growing

- Governance: financial institutions have fiduciary responsibilities to customers and regulators. Adapting their internal governance systems to deliver better ESG performance has been an area of growing importance over the past several years. Governance engagements are focused on consulting and change management activities.

Areas of emerging adoption include:

- Green lending: banks are experimenting with lending programs that provide a reduced interest rate when the borrower meets specific ESG requirements

- Standardizing metrics for evaluating the sustainability of suppliers and investments. Much of the pushback on ESG comes from using metrics that do not accurately reflect a company’s sustainability, such as greenwashing. Banks and ESG services vendors are working to identify relevant data and scrub it to make it a better indicator of an enterprise’s actual sustainability

- Standardizing the approach to ESG across lines of business and countries. Currently, multi-national banks have very different approaches to ESG issues across these silos. Banks are moving to standardize their approach to enable brand integrity and build a globally optimum response to ESG challenges.

Many ESG engagements are enhancing banks’ data management capabilities to assess and report on emissions. Below are two examples.

Case 1: British multinational bank and Capgemini

- Challenge: The client wanted to modernize its ESG data operating model and rationalize its data feeds on the emissions in its lending portfolio

- Scope of services:

- Built an ESG data store to measure the bank’s financed emissions

- Enabled tracking at the portfolio level

- Designed target operating model to deliver greater flexibility to changing regulations

- Designed data governance framework

- Benefits:

- Reduction in data sources: 50%

- Cost savings: $1m per year in third-party data sourcing spend

- Improved tracking and analytics capabilities

Case 2: Large capital markets firm and Infosys

- Challenge: The firm wanted to enhance its ESG data management for investments, and wanted to be able to:

- Ingest ESG investment data, validate it, and prepare it to be consumable at the issuer level

- Manage the large and variable number of structured and unstructured ESG data sources

- Scope of services:

- Created roadmap, conducted downstream impact analysis on consumption of ESG

- Vendor solution validation

- Implementation of ESG investments platform on AWS cloud

- Implemented NLP-based AI algorithms to support both structured and unstructured data

- Benefits:

- Productivity gain in data analysis: 50%

- Mapped 5k issuers

- Validated statistical accuracy of 400 ESG metrics

In December, I will be publishing a market assessment of ESG activities in banking, “Transforming the Banking Industry with ESG Services” which will delve deeper into how this global initiative is developing, what banks are doing to address these challenges, and how technology services vendors are supporting this transformation. Though this is a transformation that is still in its early stages, banking is one of the industries making the change quicker due to the regulatory deadlines it faces and its high use of IT services in all its business lines.

]]>

Financial institutions use legacy ERP solutions to monitor, control, and report on their business activities. At large institutions, most of these solutions were deployed in the 1990s and have inflexible architectures that need the requisite functionality to report on modern products, regulations, and industry practices. In this blog, I look at how Capgemini is helping clients tackle this challenge.

The Challenge

All financial institutions need to modernize their platforms because they have heterogeneous legacy environments due to M&A and an operational environment organized by product lines. In addition, differences in regulations and technology availability have required platform customization for each market. The market share for ERP solutions varies by sub-industry and specific market. The heterogeneous nature of all these systems makes consolidating product lines and general ledgers very difficult and often requires manual intervention.

In addition, these legacy systems face challenges, including:

- New regulations, such as IFRS 15 for banks and IFRS 17 for insurance companies, that will necessitate modernizing ERP platforms to remain compliant

- Legacy ERP systems do not have the functionality to track and report ESG issues. CFOs and all senior executives are beginning to implement ESG programs in their institutions and need to modernize their ERP systems to support ESG initiatives. Future system requirements for ESG services are not defined, so today’s platform renewal must enable flexibility to introduce new functionality with minimal disruption to the existing platform

- CFOs must close books quickly with data that provides one version of the truth. When the company decides to reorganize itself, the executives must be able to restructure systems across the new organizational structure and still generate the same reporting numbers. Today, with legacy EPR systems deployed in the 1990s, that is not the case.

As these market conditions continue to evolve, ERP solutions should be able to adapt quickly with minimal disruption to remain relevant.

Capgemini’s Approach to ERP Renewal

Capgemini has developed a program for ERP renewal in financial services to address this challenge in partnership with significant solution vendors. The program is customized by sub-industry (i.e., banking, capital markets, P&C insurance, and life insurance). Today, Capgemini partners with three solution vendors to address these problems: SAP, Oracle, and Workday.

Executives who buy these services are typically the CFO, CHRO, or CPO (Chief Procurement Officer).

Capgemini’s offering to modernize ERP platforms has five components:

- Assessments and roadmaps

- Implementation services

- Integration services

- Migration to the cloud

- Application management services.

During modernization, Capgemini rearchitects the technology environment to improve efficiency, declutter the environment, and remove customization. This “lift, shape, and shift” process to a cloud environment enables the client to convert from a Capex to an Opex cost model while achieving greater operational agility and a simplified technology environment.

Capgemini uses tools and accelerators to deliver this type of large complex project. The tools are part of its proprietary Large Transformation Program (LTP) Method. The method defines how to undertake business transformations, including successfully designing, building, and deploying solutions that can continue to evolve over time. An LTP is defined as a multi-year, multi-release, and multi-project delivery of solutions that evolve over multiple versions. Typically, LTP projects are globally delivered, requiring multi-tower services from a group of service partners. Typical benefits include productivity improvements of ~20% and cost reductions of ~30%.

Client Example

To illustrate how this is done, let’s look at an engagement with a leading multi-national, universal bank headquartered in London that wanted to transform its finance activities around an integrated general ledger (S4HANA) across multiple countries.

Business situation

The client wanted to modernize systems for country ledgers, A/P, A/R, project accounting, and fixed assets. The goals for the project were:

- Standardization and centralization of business processes

- Integration to feeder systems (e.g., T&E, B2B commerce, etc.)

- Integration of data platforms to risk data platform

- Enhance planning, budgeting, and financial closing systems using SAP FSDP to enable faster closing

- Improve cost allocation, profitability reporting, and transfer pricing capabilities.

Project scope

Capgemini delivered the following:

- An offshore COE for SAP S4HANA to support project delivery and ongoing maintenance and support

- Implementation of a Finance and Risk Data Platform

- Finance and profitability reporting using the client’s product data fields to allow franchisees and sales teams to receive accurate commissions on financial product sales

- Common data definitions and quality metrics to facilitate accurate data feeds across all bank systems.

Impact

The project delivered the following results:

- Center of excellence built with 98% offshore resources, which significantly reduced costs

- Reduced synchronization data from third-party systems to S/4 by 90% with 100% error-free status

- Implementation of Solution Manager automated job monitoring resulting in a 70% reduction in manual effort

- Migration from an HEC environment to a Hyperscaler environment reduced costs by 50%

- Reduction in manual effort and cost from move to cloud delivery

- New architecture makes implementing future platform changes easier and supports future business growth.

Summary

Large financial institutions have complex, heterogeneous legacy ERP systems that must change to address current market demands. Further, these systems will need to continuously evolve to remain relevant. Changing these poorly documented systems is a nightmare without a disciplined approach. Capgemini has developed an offering that cost-effectively addresses this challenge and enables financial institutions to improve user experience across employees, partners, and regulators.

]]>

Compliance is driving the adoption of ESG initiatives by enterprises, and currently Europe is ahead of other markets in the rigor of its ESG-related legislation and regulatory code. In this blog, I look at what Unisys is doing to make it easier for enterprises to comply with Germany’s Supply Chain Act.

Background

In 2023, several new regulations have increased compliance requirements in Europe. These include:

- Germany adopting the German Supply Chain Due Diligence Act (Supply Chain Act), effective January 2023. The law requires companies to observe basic human rights standards in their supply chains. Currently, the law covers direct suppliers. The EU is working on a law, Corporate Sustainability Due Diligence Directive (CSDDD) which will cover indirect suppliers and is applicable to all EU states including Germany; it is estimated to become effective in 2025

- The EU adopting the Corporate Sustainability Reporting Directive (CSRD), passed in January 2023, which requires EU and non-EU companies with European activities to file annual sustainability reports. These reports need to be prepared in accordance with European Sustainability Reporting Standards (ESRS)

- On January 24, 2022, the European Banking Authority announced new ESG disclosure requirements for EU banks, effective from 2023 and 2024. The requirements include disclosure of assets and activities and their exposure to climate change, customers’ and suppliers’ carbon exposure, Green Asset Ratio (GAR), effective December 2023, and Banking Book Taxonomy Alignment Ratio (BTAR), effective June 2024.

Further regulations are in the works. For example, in June 2023, the European Commission proposed regulating environmental, social, and governance rating providers that provide ESG opinions or ESG scores.

These regulations are increasing costs for all businesses and requiring fundamental data and operations management changes. It is no longer sufficient to monitor one’s operations; now, an enterprise must watch and report on third parties.

Unisys’ Approach to Compliance with the Supply Chain Act

In the past, ESG tracking solutions have been developed with individual modules for each regulatory requirement. Unisys’ approach is to build a single orchestration solution that manages the entire ESG process from a single dashboard. The ESG Orchestration Manager delivers:

- Tracking, processing, and managing supplier ESG data

- Automated risk scoring

- Supply chain transparency.

There are three components to the ESG Orchestration Manager:

- ESG portal: the supplier and whistleblower process for providing and processing relevant data

- ESG cockpit: a dashboard for managing tasks and reporting, including:

- Supplier management

- Whistleblower report processing

- Validation of risk analysis

- Risk scoring reporting

- ESG insights: provides risk scoring, social media monitoring, and digital bill of materials (DBOM), including:

- Risk analysis of suppliers

- Dashboard with geolocated supplier risk ratings

- Risk rules management

- Supply chain risk scoring

- Social media and news monitoring.

The benefits provided by ESG Orchestration Manager compared to previous approaches to ESG regulations include:

- A single solution allowing rapid compliance with this new regulation and providing flexibility to adopt new requirements into the existing solution

- Proactive use of media analysis, mitigating the risk of reputational damage

- Mitigating risk of penalties, which can run to 2% of global revenues

- Providing insights into primary and secondary suppliers

- Facilitating understanding of supply chain dependencies

- Enabling auditing of data.

Conclusion

Unisys’ ESG Orchestration Manager offering fills a need for enterprises to rapidly and inexpensively comply with the first stage of a series of Know-Your-Supplier regulations. The initial cost of compliance is high, but the ongoing cost of compliance will continue to increase.

By developing a flexible solution that can adapt to future requirements, enterprises can reduce their current and future cost of compliance while deriving useful information to drive immediate improved operational performance.

]]>

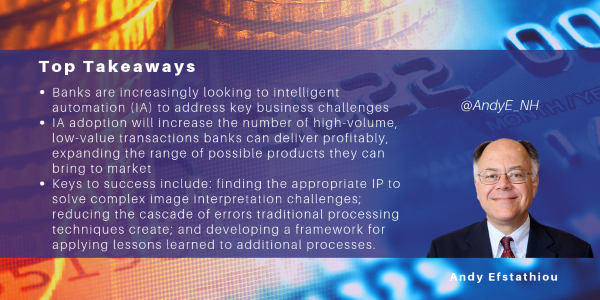

NelsonHall has just completed the research for a market assessment and forecast report on Transforming Intelligent Automation Services in Banking. We found that banks have accelerated the adoption of IA services in operations over the past two years, a shift that has been driven by:

- Declining operating margins on legacy businesses

- Pursuit of new customer demographics to replace the older customer cohort, which requires banks to launch and deliver new products digitally

- Changing business models (primarily to open banking) driven by regulations.

By transitioning operational delivery from manual to digital processing, financial institutions can drive:

- Greater brand integrity from consistent execution

- Faster time to market for new and seasonal products

- Reduced error rates which reduce costs and enable settlements on shortened deadlines

- Improved data management, which enables hyper-personalization.

IA adoption pattern

Tier-one banks have been the primary adopters, with every tier-one bank having an active IA program. Regional banks and industry services providers are increasing their commitment to IA projects. Only 30% of regional banks had IA programs three years ago; today, 75% of these banks have active IA programs. Local banks are where regional banks were three years ago, with 30% having active IA programs. Capital markets firms are late adopters but are beginning to adopt IA services to serve high-net-worth customers and meet reduced settlement deadlines.

The pace of lower-tier banks starting IA programs is accelerating, and three years from now we expect all financial institutions to be fully committed to IA in their business. The growth in clients and project scope will drive growth rates of IA revenues to 16.5% per year for the next five years to 2028. Managed services for IA operations will grow 17% over the forecast period. Growth has been fastest in mature markets, but now the emerging and APAC markets are growing faster than mature ones.

Financial institutions are focusing their efforts on the following:

- Operationalizing IA use cases: banks are deemphasizing the building of POCs to find ways to use IA and are instead concentrating on identifying high-impact use cases that can be operationalized to create value

- Improving data management: banks are changing their focus from improving data management within silos to improving data sourcing, management, and reporting across silos

- Expanding the pool of skilled employees to implement IA: banks are focusing on implementing tools (such as low/no code) that enable non-technical employees with domain expertise to build IA solutions with business impact at lower transaction volumes

- Enabling human/bot coordination and increased effectiveness: these initiatives are the least mature. Currently, banks are coordinating human/bot routines on customer-facing activities (i.e., customer contact, advisory, and lending origination). Banks are beginning to explore human/bot coordination in back-office settings, including settlements, reconciliations, and collateral management.

How vendors are enabling IA initiatives

Vendors are helping clients accelerate their IA initiatives by delivering enablement in four areas:

- Process identification and mapping: undertaking comprehensive process discovery, reengineering, automation, and embedding intelligence into processes that were previously unmapped and manual. The goal is to expand the footprint of automation in operations until all processes are digital or at least touched by digital services

- Data management: delivering three critical areas of data management:

- Data sourcing and scrubbing, focusing on standardizing data across a bank’s silos of products, markets, and sub-industries

- Expanding the range of data banks utilize into voice, image, and unstructured data

- Implementing predictive AI to support customer interactions and service

- Productizing IA offerings: the IA market has developed quickly. Most vendors have capabilities but not productized offerings. Vendors have developed productized offerings in the past two years to support lower-tier financial institutions and bank subsidiaries. These target clients are looking for rapid deployment of best practice capabilities at low cost

- Workforce effectiveness: delivering three areas of improvement:

- Developing IP, which supports employees and stakeholders in delivering IA projects with less training and fewer technical skills. This type of IP includes COEs, accelerators, APIs, low/no-code solutions, and solution libraries

- Training, including online, in-person, hackathons, and academies

- Coordination of worker/bot teams with user journey design tools and training.

Outlook

IA services in BFS are continuing to evolve new offerings and use cases. Developments include:

- New regulations, including:

- Open banking regulations, which will necessitate automating processes with third parties. This will involve integrating processes across counterparties not part of the initial financial institution. Integrating and automating processes across enterprises raises the challenge of coordinating governance

- Instant payments, which require increased automation to reduce error rates and faster settlement

- Faster securities settlement times, which require reduced error rates and faster settlement

- Application of relevant regulations to customers as they move across markets with differing regulations

- Data management, including:

- Management of third-party vendors and agents

- Use of increasingly powerful analytics requiring it to be used judiciously as well as effectively

- Increased application of IA to the omnichannel environment to:

- Increase customer choice of how to interact with banks

- Support customer interpretation of offers with visual and audio information

- Support the financial institution in understanding customer requirements and sentiment from real-time feedback analysis

- Expanding automation activities from customer-facing processes to back office and fulfillment processes. Automation to date has focused on customer interactions. Automation and AI will increasingly be applied to fulfillment processes and integrated into front-office processes.

Increasingly, business value from IA projects is less about cost savings and more about business agility. The ability to bring products to market faster and provide operational support for rapidly changing offerings is more important than cost savings on sunsetting offerings.

]]>

Capgemini has partnered with Microsoft to develop and market a dynamic hyper-personalization offering for the financial services industry. This blog explores how hyper-personalization capabilities can be adapted to the unique needs of the financial services industry.

Background

Enterprises want to increase the personalization of their offerings to customers to increase CSAT and sales success. However, effective personalization is an immature art. Enterprises have been using machine learning (ML) to drive the personalization of sales and marketing offerings to their customers. Still, the challenge of ML here is that the user can only generate incomplete information due to the iterative nature of the trials and limited contextual data. The ML bot can only observe the response to a chosen action but doesn't know the answer for other possible actions (i.e., it cannot analyze hypotheses, it can only analyze historical activities).

One method of increasing the effectiveness of personalization initiatives is using contextual-based ML techniques to improve recommendations. ‘Contextual bandits’ is a technique that reinforces the learning algorithm by using contextual information about the environment to make real-time decisions and using rewards at each step. Microsoft has embedded this technique in its Azure Personalizer solution, which enables enterprises to improve their personalization efforts to achieve better CSAT and sales closure.

The Challenge

Financial services is a lagging adopter of hyper-personalization capabilities. Early adopters are consumer industries, including CPG, consumer electronics, and media. Financial services lag in adoption due to the following:

- Heterogeneous customer bases: at the retail level, banks mix consumers and SMBs into a single practical customer base, which often has the same decision-maker, but differing needs and behaviors

- Multiple sales centers: M&A has led to multiple silos selling and competing with each other with the same products for the same customers. Banks continue to be organized by product lines, which also compete for the same clients from product silos.

These characteristics of the banking environment have made traditional AI and ML techniques a poor predictor of consumer behavior. If banks can apply additional parameters and data to understand consumer behavior better, they can develop improved personalized offers. The challenge in achieving this level of analysis is that the banks need to:

- Integrate data across channels, silos, and sources

- Access data across heterogeneous systems and environments

- Better understanding of customer needs

- Deliver personalized, integrated offers across channels.

Capgemini’s Approach

Capgemini and Microsoft have developed an offering to address these challenges. The contributions from the two companies are:

- Capgemini - IT and business services:

- Financial services solutions and accelerators aligned with Microsoft offerings

- IT services for Azure deployments and Microsoft Cloud for Financial Services

- Access to industry specialist ecosystem

- Microsoft - three software products:

- Azure Personalizer, which provides modeling tools and algorithms to contextualize a user’s content reactions

- Semantic Knowledge Graph, which extracts relationships from data and derives features for use in AI models

- Azure Synapse, a cloud-based analytics tool.

Financial institutions have had difficulty effectively implementing the infrastructure to drive hyper-personalization initiatives. Capgemini works with Microsoft and clients to drive this forward across multiple silos and LOBs. Critical to Capgemini’s activities is the ability to build systems that:

- Use real-time data

- Render the data analysis useable (using the Knowledge Graph)

- Personalize the data

- Develop a real-time trial offer

- Roll out successful offers

- Learn from mistakes in real-time.

Critically, the offering should be able to offer customers the best existing product and suggest new products for development. Suggesting product development is especially important for industry transitions, including the deployment of new regulations and changes in customer buying trends (for example, due to demographic differences). The offering also works with SMB customers, not just consumers.

This offering fills a need for financial institutions to help create personalized offerings for customers, especially from new demographic groups. Financial institutions use AI to analyze past data within silos to develop customized offerings but have not yet been able to create forward-looking offerings in response to changing conditions. This offering promises to enable banks to dynamically test and evolve their offerings quickly to meet a changing market.

]]>

The securities industry is moving towards shorter settlement cycles to reduce risk and increase efficiency. The last reduction in settlement windows in the U.S. was in September 2017 when settlements moved from T+3 (three-day settlement) to T+2. In February 2023, the U.S. SEC announced that all companies trading securities on U.S. exchanges needed to move to T+1 settlement by May 28, 2024. Canada has indicated their markets will align with this settlement timeframe and other global markets are also considering alignment. Eventually, all markets will reduce their settlement times, as they have done in previous rounds, to remain competitive globally.

In this blog, I look at the challenge of shorter settlement cycles and how Capgemini is helping clients tackle the challenge.

The Challenge of Shorter Settlement Cycles

Reduced settlement times provide two primary benefits:

- Reduction of margin required to be posted at DTCC to insure against the risk of adverse market moves during the settlement period before security is delivered

- Increase in capital available for reinvestment in businesses, due to the above reduced margin requirements and access to settlement funds one day earlier.

However, there are risks to counterparties in implementing shorter settlement times. Major risks include:

- Shorter deadlines require greater accuracy and faster processing of trades. This means financial institutions need to increase their automation of settlement processes to reduce manual error and increase execution speed

- Trading in multiple markets, with different daily deadlines, means the effective daily deadline is even shorter for certain multi-market trades. The cost of an error and the difficulty of syncing counterparties is much more difficult than in a multi-day settlement process (and will be exponentially more difficult under a T+0 deadline). Again this places more pressure on settlement systems to be fast and accurate

- Ancillary activities, especially securities lending, are heavily impacted. Securities lending are likely to generate a higher level of fails, and fails can eliminate all the profit from the lending contract. Again, the new process will need to be robust enough to reduce fails to a level where lending activities are not driven to be unprofitable

- Trading volumes are not spread out evenly during the day. The majority of trades typically occur near the end of a trading session. Batch processing of trades under a shorter deadline is likely to have an adverse impact on the ability to affirm trades. In a T+1 environment, there is simply much less time to take most of the trade volume and process it in the window available.

Transforming legacy settlement systems in the 12 months remaining to go-live will be difficult. Depository Trust and Clearing Corporation (DTCC), which provides clearing and settlement services to the U.S. markets, recently surveyed its clients and found that over 50% are unsure they can meet the deadline. Most will have to turn to third-party help to implement the complex process and infrastructure changes required.

Capgemini’s Approach

Capgemini has built an offering to support industry participants looking to transform their legacy environment in time for the deadline. The key components of this offering are:

- Readiness assessment: assessing the client’s legacy platform, which requires highly specialized knowledge due to the nature of capital markets' post-trade systems

- Solution design and implementation planning: designing solutions that increase post-trade automation and implement these solutions on top of the existing platform

- Implementation: implementing a regulatory-compliant solution in an environment that is delivering high-volume ongoing services daily

- Testing: internal testing to assure success with the custom internal platform and external testing to coordinate with industry and regulatory partners

- Post-go-live remediation: to fix flaws and upgrade solutions over time

- Managed services: ongoing support as required and/or full outsourcing.

The key success factors for these projects are:

- Effective data management, which is critical to delivering the clean data required to meet deadlines by avoiding disputes

- Rapid automated processing to reduce manual errors

- STP to enable firms to meet regulatory deadlines.

Delivering these services successfully in a compliant fashion requires industry experience and a methodical plan to address each participant's custom environment. Achieving a compliant launch for complex custom systems in a 12-month timeframe, when over half of the participants are unsure they can meet the regulatory deadline, will require participants to use best practices as soon as they evolve within the next 12 months.

The business impact of successfully transitioning to shorter settlement deadlines is that counterparties will free up working capital to reinvest in their businesses. Collectively this will generate greater industry liquidity and reduce transaction costs for both investors and issuers. Greater market liquidity will allow more efficient markets to put more capital in both investors’ and issuers’ pockets.

Support from third parties will assist organizations with industry coordination and best practice adoption on this fast-track systems conversion project. Capgemini is well placed to capitalize based on its new offering and its track record in successfully assisting clients with T+3 to T+2 transition.

]]>

The lending business is highly cyclical due to its sensitivity to interest rates, economic cycles, and capital availability to fund loans. According to the Mortgage Bankers Association, these factors are currently driving down mortgage originations, which have fallen 60% y/y in the U.S. in Q4 2022.

The decline in originations pressuring the margins of this high-cost activity is the leading change in the industry. Delinquencies, while currently low, are expected to grow rapidly over the next year as the economy slides into an anticipated recession. Banks need to increase their agility to deal with these volume shifts cost-effectively. There are two key levers to address the shift in processing volumes:

- Automation, which enables an absolute reduction in OPEX based on upfront investment

- Outsourcing, with committed volume flexibility, enables the matching of revenues and costs.

Of the two, the more compelling savings can be made from automation, as long as transaction volumes across the entire business cycle can justify the initial investment. Mortgage origination is a clear first choice for automation because:

- The cost of mortgage origination in the U.S. is typically 10x the cost of servicing ($5k to $10k per loan in the U.S. depending on product complexity and lender platform maturity)

- Origination remains mostly a manual process. Most Loan Origination Solution (LOS) platforms in the market are providing only partial STP processing, relying mostly on manual sub-processes

- Originations are highly cyclical.

Lenders and services vendors are trying to address the mortgage origination challenge, and while no single model has won the market, the as-a-service model looks most promising.

WNS has developed a mortgage-as-a-service (MaaS) offering, working with mortgage lenders for years, and has identified many typical breaks in legacy processes where processing is manually delivered. Critical to the success of a MaaS offering is bringing the most effective resources to bear at each step of the process. The choices include:

- Intelligent Automation of manual processes, where possible

- Optimal shoring of processes, where manual processing remains necessary

- Flexibility for clients to opt for unit-based pricing model

The key steps in the origination process where MaaS transforms processing are:

- Pre-processing and sending initial loan estimate: after receiving the application, the MaaS delivers an initial loan estimate within three days. All offshore delivery

- Third-party orders: auto-triggered order checks including flood, credit, verification of employment, verification of deposit, title, mortgage insurance, appraisal, fraud, etc. All offshore delivery

- Document validation: documents have data extracted and are converted to a digital loan file. Exceptions are handled manually. All offshore delivery

- Conditions management: decision engine and underwriting, automatically raising conditions for consideration by loan officers. Combined onshore/offshore delivery

- Document reviews: review and analysis of income, collateral, asset, title, Agreement of Sale, and fraud. Combined onshore/offshore delivery

- Approval: onshore lender works with the offshore team to approve the loan package. Combined onshore/offshore delivery

- Loan closing: LE and CD prep of documents; schedule closing with the title company. Combined onshore/offshore delivery

- Transfer to servicing: digital loan file transfer to servicing platform. All offshore delivery.

The backbone of the MaaS offering is a combination of

- Smart Workflow platform with integrated APIs to collect third-party information along with inbuilt models for underwriting

- Intelligent automation powered by RPA and Artificial Intelligence.

The MaaS service integrates with the client LOS platform and digital front end to deliver services to bank customers. Because the offering is modular, clients can buy point solutions to automate individual components of the origination process.

Technology is necessary, but not sufficient for successful transformation of the loan operations process. The human element is a critical component of the success of the MaaS offering. The MaaS offering incorporates the development and utilization of talent with a comprehensive understanding of the mortgage process, associated challenges, and parameters of compliance and non-compliance. Initial and ongoing training and examinations in end-to-end loan review including compliance measures are required to continually improve the quality of performance and service levels that complement the areas of automation.

WNS’ MaaS offering has been delivering lenders benefits including:

- Productivity gains of 3x from automation and global delivery

- Customer inquiries and complaints: 50% reduction

- Reduction in loan origination costs: 40%

- QA/QC processes eligible for automation: 70%

- Loan final closure in 15 to 20 days.

These benefits are especially compelling as origination volumes decline and a MaaS service connects costs to revenues, allowing for costs to decline as volumes plummet. We expect to see the industry produce more MaaS offerings as the economy continues to shift. Early vendors, such as WNS, will have more mature offerings as lenders shift to outsourced as-a-service operations models.

]]>

In the financial services industry, there was an initial expectation that demand for intelligent automation (IA) would fall off as clients changed platforms and moved to a microservices architecture. Instead, the application of IA in financial services has grown rapidly. The initial evidence from my current study shows that despite challenges deploying the technology effectively, the ability to bring decision making to the line-of-business user at a low cost of implementation makes a compelling value proposition.

Despite its ability to accelerate accurate, transparent process execution, implementing IA effectively is challenging. Key challenges include:

- Use case failure rate: the majority of use cases have not met their promised returns. Most POCs have not been operationalized. Increasingly, ITS vendors have had to build COEs and use case libraries to increase the cost effectiveness of IA projects. Success rates are rising, but only where ITS vendors are able to marry client operational knowledge with industry best practice

- Orchestration of bots: operations is a dynamic environment and bots are unable to reskill or change jobs without advanced orchestration services. Performance degrades rapidly in a poorly orchestrated environment

- Dynamic nature of business processes, including cyclicality, reengineering, and sunsetting: the tempo and structure of operations changes with time, requiring continuing process reengineering and new use case development

- Heterogeneous core banking platforms: most banks today are an amalgam of multiple platforms. Deploying automation across multiple environments and architectures requires process discovery, reengineering, and consolidation.

Despite these challenges, IA activities have taken off because:

- Banks lack sufficient investment capital for full platform replacement

- Bots have benefited from increasing functionality, mostly due to increased AI capabilities, which enable them to deliver greater value. For example, banks need to increase their employee productivity. The AI used for bots has been used to develop human/tech coordination capabilities which have enabled better customer interactions and improved internal software development

- Technology services vendors and banks have improved their use case validation methods, leading to greater success in operationalizing initiatives.

Over the past several years, as automation services have matured, banks have begun narrowing the number of processes they are spending resources on automating. Processes where IA is increasingly applied are:

- Technology development, especially software development

- Customer contact, especially human/bot delivered contact; often focusing on support for independent agents (such as third-party mortgage originators or independent wealth advisors)

- Cyclical processes, such as loan originations/collections, payments, and portfolio due diligence

- Compliance, with a heavy focus on KYC and AML processes

- Data management, especially in mining new sources of data (from social media and third-party data vendors).

IA adoption will continue to grow faster than overall technology adoption in the financial services industry because banks need to move fast to deal with rapidly declining margins and the need to change their business models. Automation vendors are remaining relevant in this developing market by investing heavily in building more AI functionality. Vendors who are struggling are the ones who have failed to embed robust new AI functionality in their offerings. Ultimately, intelligent automation is less about process automation and more about helping banks orchestrate their labor forces and business partners to deliver service to customers.

]]>

NelsonHall recently completed a market assessment and forecast report on Transforming Financial Services with Cloud, SaaS, and BPaaS Services. It reveals that the financial services industry is responding to the industrialization of cloud services from hyperscalers and IT services vendors by transforming its platforms to microservices architectures and then moving them to the cloud. Data management across markets, businesses, and entities has moved to center stage to drive compliance and customer management.

The operational transformation challenge

Tier 1 banks are looking for increasing operational agility with migration to cloud and as-a-service delivery. Smaller banks require productized solutions and SaaS/BPaaS services. All banks are increasing their data management and AI purchases. In the future, banks will move towards SaaS and BPaaS to reduce labor costs and increase the configurability of their businesses. Operational delivery will become agile to support reducing time to market and accommodate volume fluctuations.

However, the external environment has put up barriers to transformation. The key barriers impeding banks’ transformation efforts include:

- Platform modernization: legacy mainframe platforms need to be redesigned into a microservices architecture. Finding teams that can work with both legacy and modern languages is difficult

- Data management and analysis: effective use of AI requires large databases from which to derive insights. Most bank portfolios are too small to generate large data sets for meaningful analysis

- Accessing emerging technologies: skilled labor remains in short supply and worker turnover has made it worse

- Creating a roadmap: new business models require experimentation and agility, which large banks find difficult to undertake effectively.

Financial institutions must adapt transformation strategies

To transform their businesses, financial institutions will have to:

- Create a strategy that moves operations to the cloud and matches costs to revenues to enable greater agility. They will have to change their business model to an open banking model

- Build an ecosystem of operational vendors including: hyperscalers, with each one providing services in their area of expertise; IT services vendors with knowledge of the client’s environment; and FinTechs with key functionality

- Redefine the split of operations between external processes (high value, cyclical or one-time) and internal processes (lower value/less volatile)

- Acquire orchestration tools to manage a heterogeneous environment of vendors and products

- Transform application development to a DevOps and low/no code model to speed the innovation cycle and enable LOB staff to have greater input.

Services vendors are supporting clients with different services for each environment:

- Cloud: support for entering new markets and enabling open banking

- SaaS: data management tools, analytic tools, and data and solution provider partnerships

- BPaaS: offerings focused by line of business which have high volatility (e.g., collections and securities)

- Platforms: provision of low code/no code DeFi coding capabilities, APIs to solution/data vendors and industry consortia, enhanced solutions with hyperscaler partnerships, and orchestration tools to manage hybrid multi-cloud environments.

Summary

In summary, high competition and regulatory change is driving banks to focus on changing their business models and product mix. The change to shorter product cycles and lower margins means banks changing their operational focus from cost efficiency for fundamentally static businesses to agility for continuously changing businesses. Cloud, SaaS, and BPaaS infrastructure will drive accelerating change in banks’ product offerings, customer base, and market presence. The financial industry is at the start of a long-term transformation of its business model.

Find out more about NelsonHall’s Transforming Financial Services with Cloud, SaaS, and BPaaS Services market assessment and forecast report here or contact Guy Saunders.

]]>

2022 has been a very strong year for IT services firms delivering cloud, digital, and AI services to the financial services industry. 2023 looks to be a very different year for these vendors as they are finding it difficult to hire skilled resources, find clients able to fund new large projects, and partner in strategic growth areas. Successful BFS technology consultants will need to focus limited resources in a few key growth areas to have a successful business in 2023. One strategic area for growth will be implementing transaction processing AI and data management tools.

To date, banks have focused their AI efforts on entity or account analytics. Typically, these tools provide customer service (e.g., customer onboarding and next-best recommendations) and compliance support (e.g., AML/KYC). We believe in 2023 banks will turn their compliance and customer analytics focus from entity analytics to transaction analytics. Financial institutions are driven by evolving regulations, which today are emerging faster from Europe than other geographies. Europe has several new regulations which are driving a change in focus to transaction monitoring. These include:

- The Digital Operations Resiliency Act (DORA): DORA seeks to mitigate the risk of cyber attacks on financial operations. Previous regulations took a balance sheet-based approach to risk mitigation by requiring capital buffers to address operational risk. DORA takes an operational approach to mitigating risk by requiring technology (i.e., cloud, supply chains, and IT outsourcers) to operate with transparency, rigor, and resiliency. The act was published on 11/17/2022, will come into force by Q1 2023, and financial institutions will be required to have implemented it by Q4 2024.

- A pilot regimen for market infrastructure in DLT: Passed June 2, 2022 by the EU, this regulation covers trading of currencies/securities using blockchain technology in multilateral trading facilities and settlement systems

- Regulations governing real-time payments/transactions: regulations include PSD2 and various securities settlement regulations, which have been shortening the settlement windows for various securities transactions towards an ultimate goal of instant transactions. Platforms need to move from batch processing to real-time processing with improved security and risk management to mitigate fraud and credit risk. An example of real-time payments implementation is the launch scheduled for summer 2023 of FedNow, the Federal Reserve bank’s instant payment service.

These regulations will drive securities exchanges, payments networks, banks, and capital markets firms to deploy cloud orchestration and AI FinTech tools to improve security and reduce operational risk. Already financial institutions are starting projects to address these challenges. Examples include:

- Goldman Sachs Transaction Bank (GS TxB): On Sept. 15, 2022 GS TxB announced a partnership with Stripe to provide corporate treasury services with embedded finance (the ability to make payments as part of the treasury application). This service requires APIs and AI to manage and deliver transaction flows safely and securely.

- State Street Bank launching a peer-to-peer repo program for the buy side to reduce the cost of collateral management, which is a critical trading cost. This facilitates bilateral trading by counterparties with varying credit and capital strength.

Implementing these transaction-oriented FinTech solutions is more complex than account-based solutions because transaction-oriented solutions require orchestration and transparency across the entire network infrastructure. These projects will be driven by the market exchanges and tier one institutions, but will require cooperation from all market participants.

The result will be a more robust financial infrastructure with smaller participants benefiting from the move to an open banking environment for transaction processing. The promise of safe digital payments in a decentralized environment will not be achievable without these investments in securing the industry infrastructure. The industry and regulators are committed to delivering on the promise, so the implementation work will start in 2023.

]]>

In NelsonHall’s recently published market assessment, Transforming Mortgage and Loan Services, we found that lenders are changing their approach to mortgage and loan operations from a focus on BPS and integration services to a focus on cloud migration and data management services.

The goal for lending institutions today is to be able to support open ecosystem models, new product introductions, and process automation delivered for a wider range of lender types based on cloud-delivered operations. The pace of industry change is increasing, while the industry begins its cyclical shift from a focus on originations to default management services. The shift to cloud and digital-first delivery has expanded the scope of transformation projects as more processes are opened to third-party partners.

The state of digital operations in the lending industry

For the past year, lending institutions have been:

- Implementing intelligent automation to reduce manual processing and increase accuracy